|

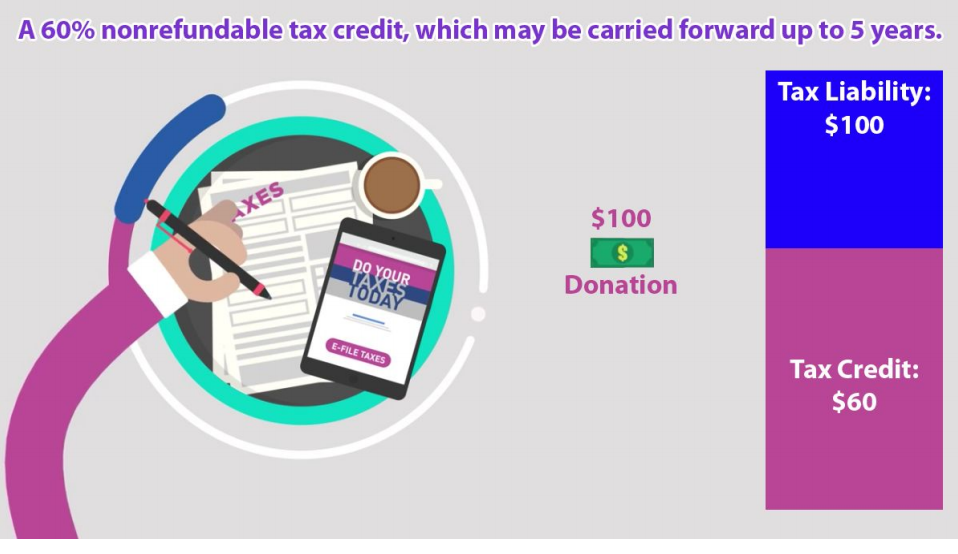

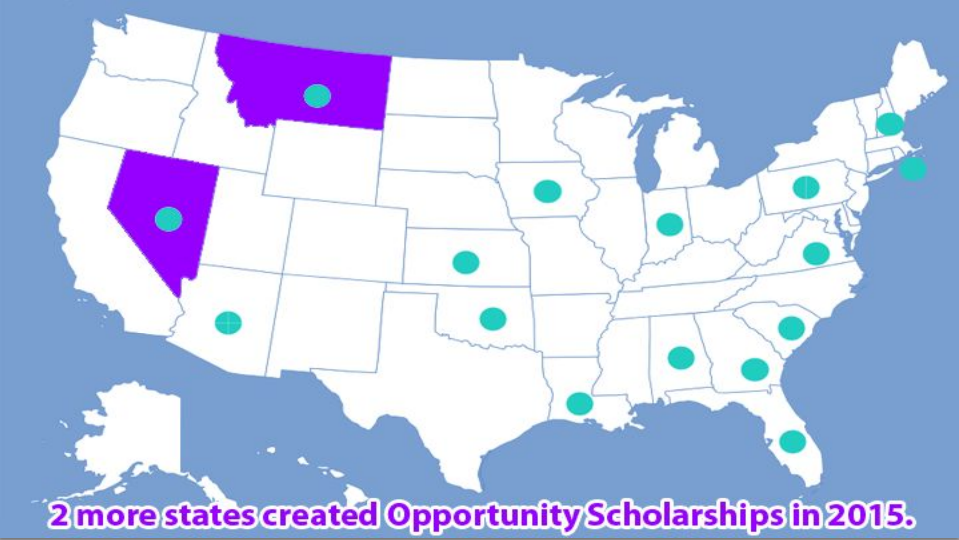

At the Platte Institute's annual Summit a couple of weeks ago, Senator Bob Krist spoke about Opportunity Scholarships, an important school choice measure that has the potential to help low-income students to thrive in schools that are currently financially out-of-reach for them. As seen in the image below, opportunity scholarships are funded by individuals, estates, trusts, and businesses, and these entities receive a tax credit for donating to the scholarships. Therefore, more money would be available for Nebraska's K-12 students without taxpayers having to bear any additional burden. Opportunity Scholarships give parents the choice to improve the educational outcomes they decide on for their children. They improve accountability in education to parents and taxpayers by holding poor performing public schools accountable for academic performance because these schools may lose students in the choice options. Opportunity Scholarships afford this accountability without the need for intrusive government regulations that create political and market liabilities for school choice policies. Fifteen states have educational tax credits in place already. Charles M. North, Associate Professor of Economics at Baylor University, estimates that Arizona's tax credit scholarship program has saved Arizona taxpayers between $99.9 million and $241.5 million due to students enrolling in private rather than public schools. Nebraska is currently facing two crises: unsustainable levels of taxation and an ever-widening K-12 achievement gap. Opportunity Scholarships can help alleviate both problems. Look for Senator Krist's Opportunity Scholarship legislation this coming session, and contact your state senator to voice your support.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

|

RSS Feed

RSS Feed