|

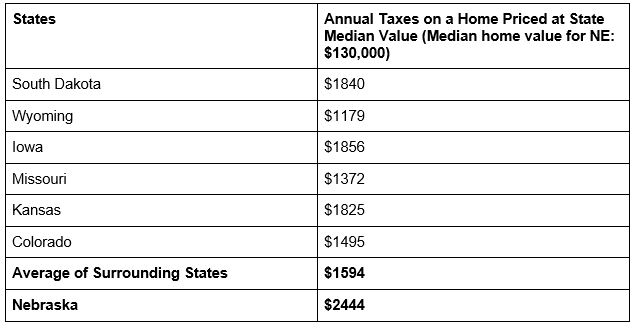

A single mom working full-time at a minimum wage job earns less than $20,000 a year in Nebraska. An extra $850 a year would make a big difference to her family. If she lived in any one of the states bordering Nebraska (South Dakota, Wyoming, Iowa, Missouri, Kansas, or Colorado), she’d have about $850 more every year through lower property taxes. Who is taking most of this above-and-beyond money from her? Her local school board. The average Nebraskan household pays $850 more each year than the average household in the surrounding states. You’re not immune from property taxes if you rent. Although the landlord writes the check for property taxes, the funds for that check come straight from the rent, which would be lower otherwise. Just think about the improvement to our students’ lives and our local economy if every household had that much more money to work with every year. In Nebraska Loves Public Schools’ film Poverty: Not a Choice, students say, “We are people who just need a helping hand.” Their website decries “the pockets of inequity and poverty affecting kids in public schools today.” And yet, it’s their own school boards who are creating pockets of poverty right here in Nebraska. Families in the surrounding states are not taxed as heavily. They can afford more food, clothing, lessons, and enrichment than Nebraskan families can. An Example of Careless Spending The LPS School Board is currently entertaining a proposal that highlights the misguided spending of the communities’ money. In recent years, interest has fallen for the Zoo School, also known as the LPS Science Focus Program; there are currently well under 100 students enrolled. And yet, the board of education is entertaining the prospect of spending $3 million on a building for them. The LPS public relations writer says the new Zoo School could accommodate up to a total of 200-250 students. Even if interest increases and that many students decide to attend the Zoo School, that’s an incredible amount of money spent on each one of those students, who spend just half the school day at the focus program. And the building wouldn’t even be built on land owned by the school district. Surely the public relations writer has left out some key information because this proposal doesn’t make any sense. There’s more to this story, but the rest isn’t being reported. Are questionable proposals like these worth the $850 per year that many Lincoln families are losing? Does it make sense to take all that money and put it toward an elaborate building that benefits fewer than 100 kids when every single child in the district could benefit from lower property taxes? The Ingenuity of Parents It’s clear that the LPS school board isn’t managing our $850 well. When it comes to their children, parents are full of ingenuity. They know their kids better than anyone else, and they will know best what to do with their own money. They’ll also stretch it as far is it can possibly go. They might start a 529 fund. They might pay off debts or save for a rainy day. They might hire a violin teacher or buy a pair of running shoes for their children. They might pay down their medical bills, fix a broken window, or move to a house with a yard. Just think of what all that money could do in our local economy if we the people could just have a say in how our own money is spent. There’s no reason we have to be outliers when it comes to property taxes. Other states manage to educate children without increasing poverty among its own citizens. We can do it, too.

0 Comments

|

|

RSS Feed

RSS Feed